How Forensic Quantity Surveyors impact construction dispute resolution - a UAE, KSA, Australia comparison

The construction industries in the United Arab Emirates (UAE), Saudi Arabia, and Australia encounter distinct challenges in dispute resolution.

This report compares these countries based on the size of their construction markets, frequency of disputes, litigation rates, and the involvement of forensic Quantity Surveyors (QS) in managing and reducing disputes. Furthermore, it addresses the current shortage of Quantity Surveyors in Australia, which impacts the industry’s ability to manage and resolve disputes effectively. This analysis highlights the critical role that forensic QS professionals play in mitigating disputes and offers insights and recommendations to enhance dispute management across these regions.

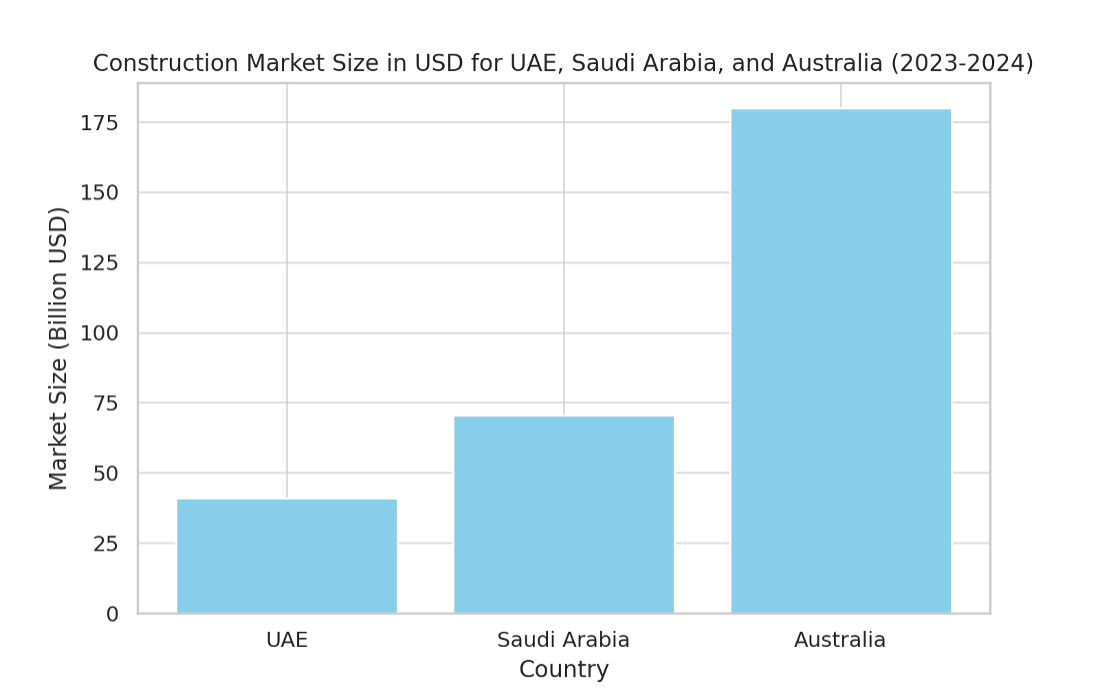

Construction Market Size Comparison (2023-2024)

As of 2024, the construction market values for each country are estimated as follows:

- UAE: USD 41 billion, projected to reach USD 50.4 billion by 2029, with a CAGR of 4.26%.

- Saudi Arabia: USD 70.33 billion, with projections to reach USD 91.36 billion by 2029 (CAGR of 5.37%).

- Australia: USD 180 billion, underscoring its significant role in the economy.

The data reveals that Australia’s construction market size is much larger than that of the UAE and Saudi Arabia combined, which increases the potential for disputes due to the complexity and volume of projects.

Figure 1: Construction Market Size in USD for UAE, Saudi Arabia, and Australia (2023-2024)

Incidence of Construction Disputes

The frequency and cost of construction disputes differ significantly across the regions, as shown in Arcadis' 2023 report:

UAE: USD 62 million per dispute, with a frequency of 20 disputes per 100 projects.

Saudi Arabia: USD 86 million per dispute, with 25 disputes per 100 projects, partly due to high-value mega-projects.

Australia: USD 56.1 million per dispute, with a higher frequency of 30 disputes per 100 projects.

Australia’s higher dispute frequency underscores its need for a more robust approach to dispute management, suggesting that increased forensic QS engagement could provide expertise in managing costs and reducing delays.

Figure 2: Average Dispute Value in Construction Projects (USD Millions)

Litigation Rates in Construction Disputes

Litigation rates also show a marked variation among the three countries:

UAE: 40% litigation rate, with a growing preference for Alternative Dispute Resolution (ADR) methods.

Saudi Arabia: 60% litigation rate, indicating a stronger reliance on formal dispute processes.

Australia: 55% litigation rate, with frequent court involvement.

Australia’s high litigation rate suggests that disputes often escalate to formal legal processes rather than being resolved through ADR. Increased forensic QS engagement could support dispute resolution without requiring litigation, reducing project delays and costs.

Figure 3: Litigation Rate in Construction Disputes for UAE, Saudi Arabia, and Australia

Impact of Forensic QS Engagement on Dispute Resolution

Forensic QS professionals significantly impact dispute resolution outcomes, providing expert analysis that reduces both the frequency and cost of disputes. The following data demonstrates the global impact of QS involvement in construction disputes:

UK: RICS reported a 25% reduction in dispute occurrence and a 30% decrease in resolution time for projects with QS engagement.

Australia: The Australian Journal of Construction Economics noted a 20% reduction in litigation cases with forensic QS involvement.

The Middle East: The RICS World Built Environment Forum highlighted a 15% reduction in dispute values and a 20% decrease in resolution times in the UAE and Saudi Arabia with QS support.

These statistics emphasize the value of forensic QS engagement for proactive dispute management, especially in complex markets like Australia.

Skills Shortage of Quantity Surveyors in Australia

The Australian construction industry is currently experiencing a significant shortage of Quantity Surveyors (QS), with substantial implications for project costs, timelines, and dispute resolution. This shortage is exacerbated by rapid industry growth and increasing project complexity. According to Jobs and Skills Australia, 36% of assessed occupations were in national shortage in 2023, with Quantity Surveyors among the most affected professions.

The shortage of qualified QS professionals leads to inadequate cost estimation, contract management, and financial oversight, increasing the likelihood of disputes. Forensic QS experts are essential in providing accurate cost assessments and contract evaluations for dispute resolution, yet their scarcity can result in prolonged disputes and higher litigation rates.

Figure 4: Correlation between QS Shortage and Construction Disputes in Australia (2019-2023)

Conclusion and Analysis

The analysis demonstrates that forensic QS professionals play a pivotal role in reducing disputes in construction. Australia’s high litigation rate, frequency of disputes, and significant QS skills shortage underscore the need for enhanced forensic QS engagement to contain costs, minimise delays, and streamline dispute resolution.

Addressing the QS skills shortage through targeted training, career promotion, and skilled migration could help Australia handle its growing construction market demands effectively. As demonstrated in the UAE and Saudi Arabia, increasing forensic QS involvement in Australia could lead to lower dispute values, reduced litigation, and more efficient project outcomes.

At Accura Consulting, our team of experts work with clients to create a tailored solution to problems. If you have an issue and want expert support, get in touch.

References:

Arcadis. (2023). Global Construction Disputes Report 2023. Retrieved from https://www.arcadis.com/en/knowledge-hub/perspectives/global/global-construction-disputes-report

Mordor Intelligence. (2024). UAE Construction Market - Growth, Trends, and Forecasts. Retrieved from https://www.mordorintelligence.com/industry-reports/uae-construction-market

Mordor Intelligence. (2024). Saudi Arabia Construction Market - Growth, Trends, and Forecasts. Retrieved from https://www.mordorintelligence.com/industry-reports/construction-sector-in-the-kingdom-of-saudi-arabia-industry

Australian Bureau of Statistics. (2024). Construction Work Done, Australia. Retrieved from https://www.abs.gov.au/statistics/industry/building-and-construction/construction-work-done-australia

Jobs and Skills Australia. (2023). Skills Shortages in Australia. Retrieved from https://www.jobsandskills.gov.au/publications/towards-national-jobs-and-skills-roadmap-summary/current-skills-shortages

Royal Institution of Chartered Surveyors (RICS).

Back to News and Insights

![Case Insights: V601 Developments v Probuild [2021]](https://images.squarespace-cdn.com/content/v1/65af0cb0b236385076bf98f3/1766370745657-5MWGRDHF5V6PT70FHFDA/unsplash-image-PlBsJ5MybGc.jpg)